Many startup companies do not even have a collection department to handle these tasks. Spot factoring, on the other hand, all you need to provide is an invoice from a business customer that has a good credit background.Ĭollecting accounts with 30 to 60-day terms is quite a daunting task, especially for many businesses, especially startup companies. Also, not to mention that every bank has different criteria for approving a loan. Allowing businesses to take on larger projects that they would otherwise not be able to pursue.Ī traditional bank loan process can take up to three months to get approved. This means that if your business badly needs a tremendous amount of money to fund something important, then factoring is the best choice. Some spot factoring(single invoice factoring) companies offer a one day process application. Factoring allows you to get your money immediately and avoid any cash flow problems. So the only way you work with some customers is by accepting their terms. Most large customers will require you to offer them terms. Giving long payment terms to clients is often necessary to ensure their loyalty to your business. The secondary reason why a lot of companies use factoring is that it maximizes their business cash flow, especially from their slow-paying customers. Also, factoring offers the following advantages for business The main benefit of invoice factoring is that it provides immediate cash that’s tied up in unpaid invoices. Remaining balance minus interest expense released to clientįor some businesses, particularly small companies and startups with limited capital, factoring is the best solution.Unpaid Invoice is Collected from Debtor.

Factoring invoices for headhunters verification#

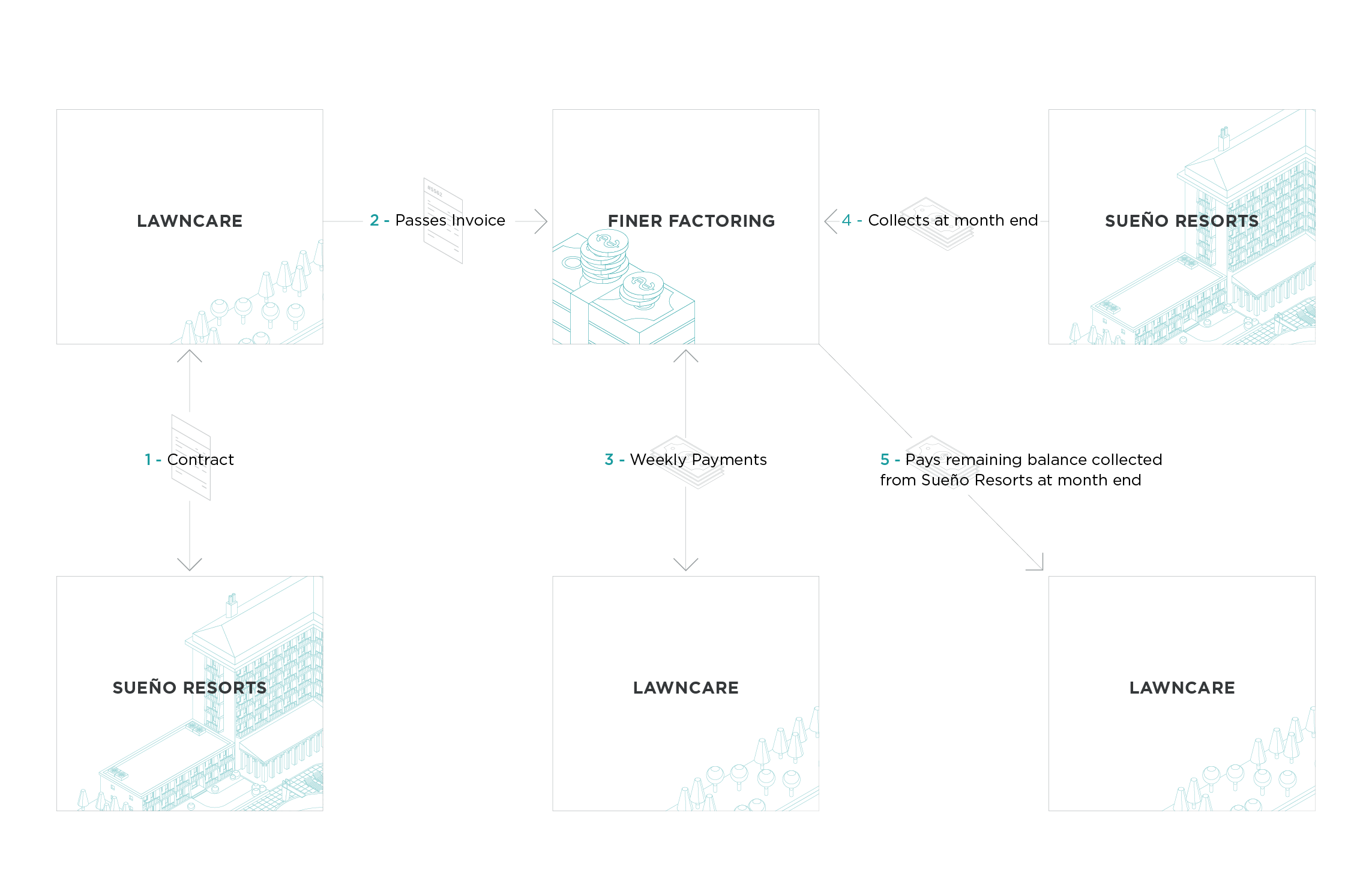

Credit on Debtors and Verification of Invoice.Note that there is a monthly factor rate to be deducted. Once the factor received payment from your customers, they will release the remaining balance to you. At this point, the factoring company owns the receivable, right through to receiving and posting payments from the customer. Your customer would then pay to the terms and make payment to the factoring company. Once they’ve received and approved the invoices, they will release up to 98% of the invoice value in your bank account, which is often the same day. You would then send a copy of the invoice to the factoring company. You would deliver goods or services to your customers and offer credit terms. Once your application is approved, you will sign a financing agreement that also states the initial amount you can borrow. To obtain factoring financing, the factoring company will have to review your eligibility and conduct due diligence on your customers. Here are the steps to understand it better: It provides them with working capital as a way of improving cash flow and reducing operating expenses. The factor buys the company’s outstanding invoices from creditworthy customers. The process is simple and straightforward. Three parties are involved in factoring financing arrangement Your business, your customer, and the invoice factoring company. You are able to generate working capital from your unpaid invoices. Invoice Factoring is Accounts Receivable Financing. But with a factoring company (Factor), the amount of cash advance is typically based on the value of the company’s invoices, not the credit score. Most banks and traditional lenders do not allow cash advances for businesses with poor credit history. Invoice factoring is a solution that releases cash tied up in your outstanding customer invoices so you can get paid when issuing invoices. However, most businesses can’t wait that long to receive payment from their customers because they have to manage other important expenses to keep the business operations running smoothly.

These can sometimes range between 30 and 90 days. What Is The Difference Between Non-recourse and Recourse Factoringī2B organizations typically offer credit terms to their customers.

0 kommentar(er)

0 kommentar(er)